Texas Franchise Tax Report 2025 Instructions W2

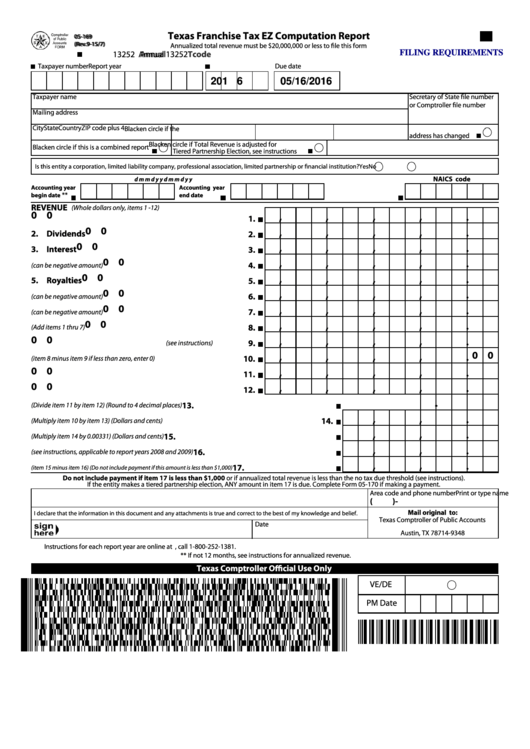

BlogTexas Franchise Tax Report 2025 Instructions W2 - Texas Franchise Tax Form Instructions 2025 Erda Odelle, This year the state of texas changed its filing requirement so that we no longer have to file the no tax due reports. Texas Franchise Tax Report 2025 Instructions W2. Learn about texas franchise tax report due dates, fees, & requirements. The official name is the texas franchise tax report but in most tax offices, it’s referred to interchangeably as a return or report.

Texas Franchise Tax Form Instructions 2025 Erda Odelle, This year the state of texas changed its filing requirement so that we no longer have to file the no tax due reports.

Texas Franchise Tax No Tax Due 20252025 Form Fill Out and Sign, Texas has made several changes that apply to report year 2025 (calendar year 2023) increasing the “no tax due” revenue threshold from $1.23 million to $2.47.

Texas Franchise Tax Instructions 20252025 Form Fill Out and Sign, We must only submit the public information.

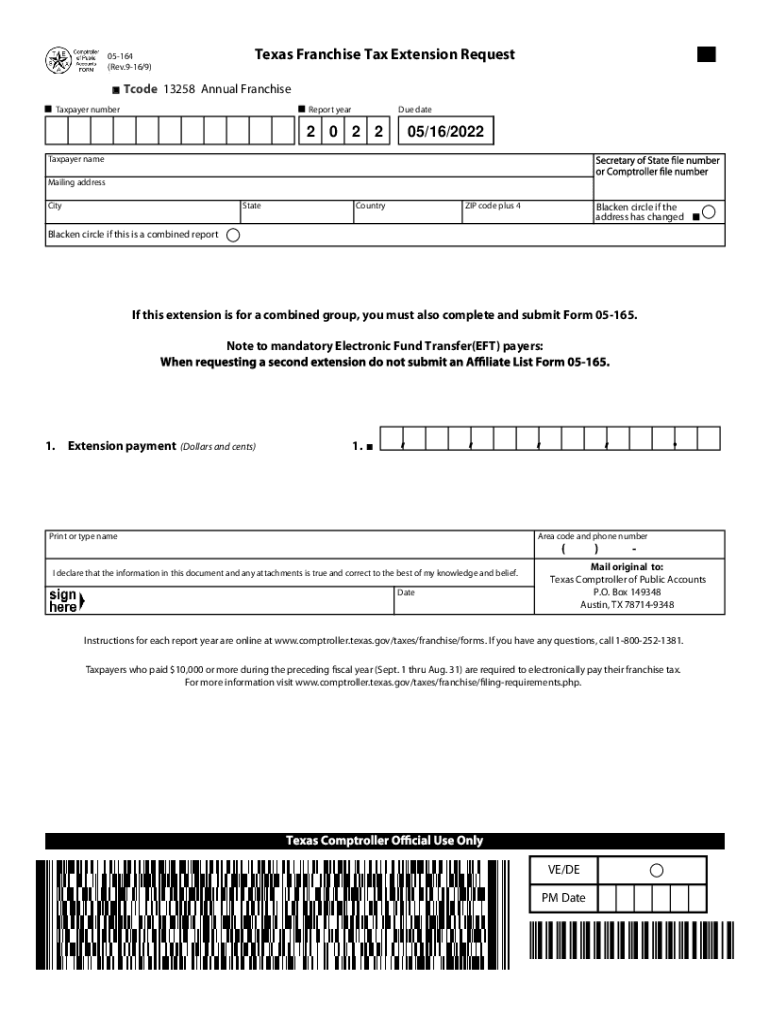

How To File Texas Franchise Tax Report, The second extension for 2025 texas franchise tax reports is august 15, 2025.

Fillable Online 2025 Texas Franchise Tax Report Information and, Taxable entities doing business in texas are required to file an annual franchise tax report and pay any franchise tax due on or before may 15 of each year.

Texas Franchise Tax Instructions 2025 Patsy Bellanca, We must only submit the public information.

Fillable Online 2023 Texas Franchise Tax Report Information and, The texas franchise tax is levied annually by the texas comptroller on all taxable entities doing business in the state.

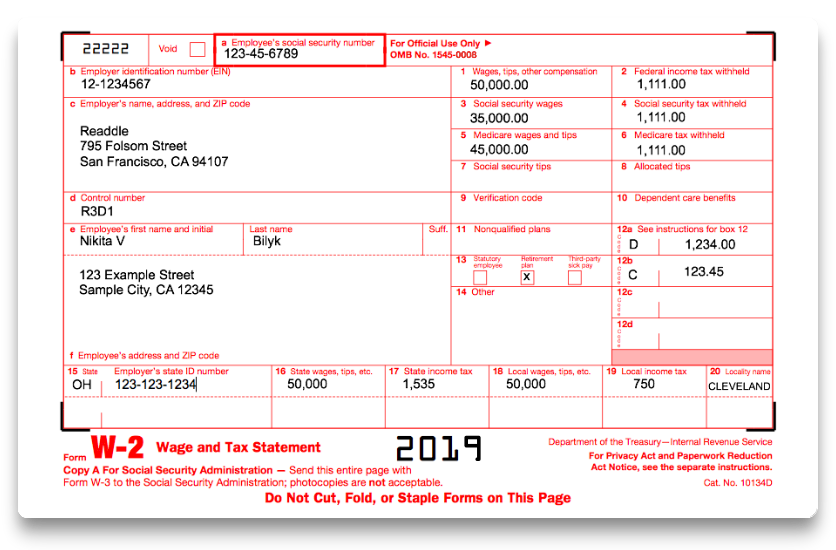

W2 Form 2025 Explained Brook Collete, We must only submit the public information.

Texas has made several changes that apply to report year 2025 (calendar year 2023) increasing the “no tax due” revenue threshold from $1.23 million to $2.47. The texas franchise tax is levied annually by the texas comptroller on all taxable entities doing business in the state.

2025 W2 Tax Form Hilda Larissa, We need a solution to this as soon as possible.